Payroll Management Software

Cut down time spent on payroll operations to just 2 hours per month

Ensure accurate, timely, and compliant payroll processing for businesses of all sizes.

Please contact your HR or IT department in case you do not know your organization URL

Ensure accurate, timely, and compliant payroll processing for businesses of all sizes.

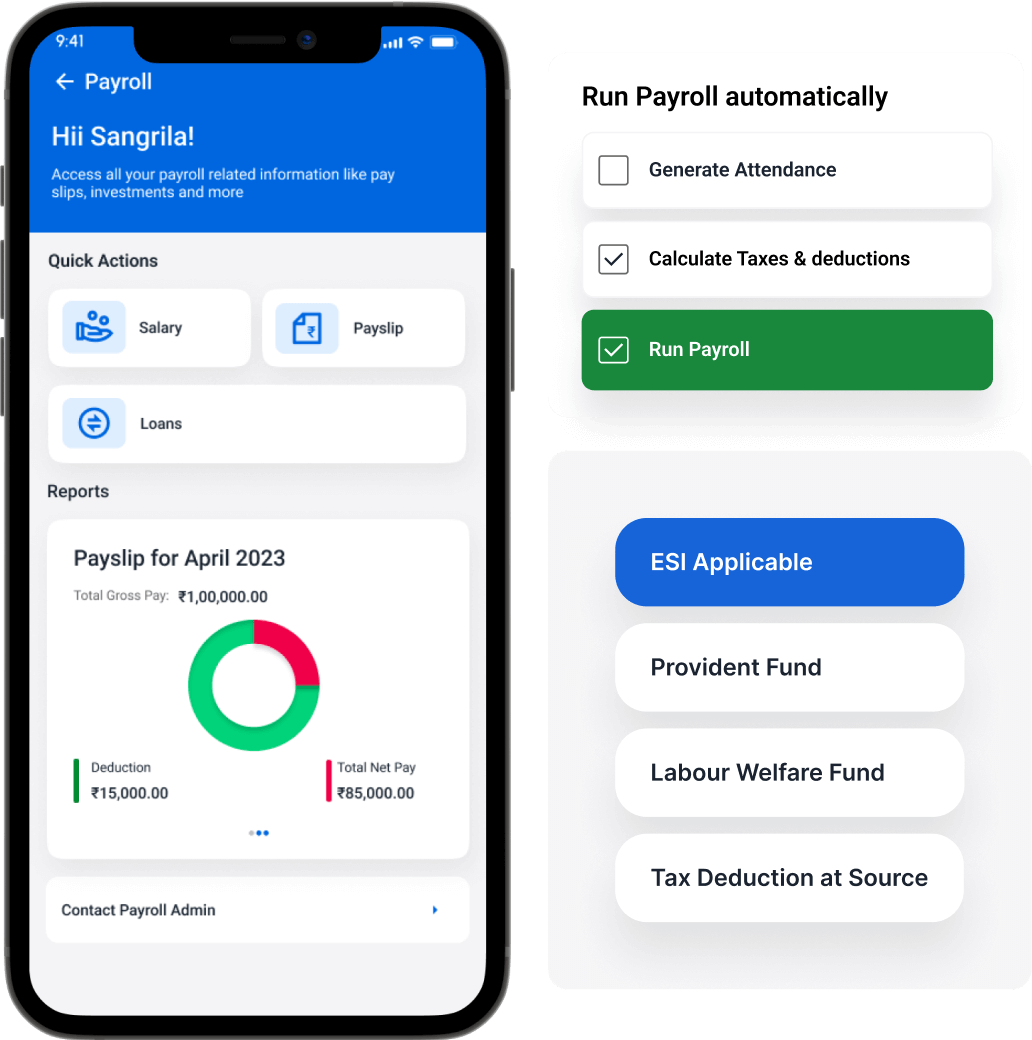

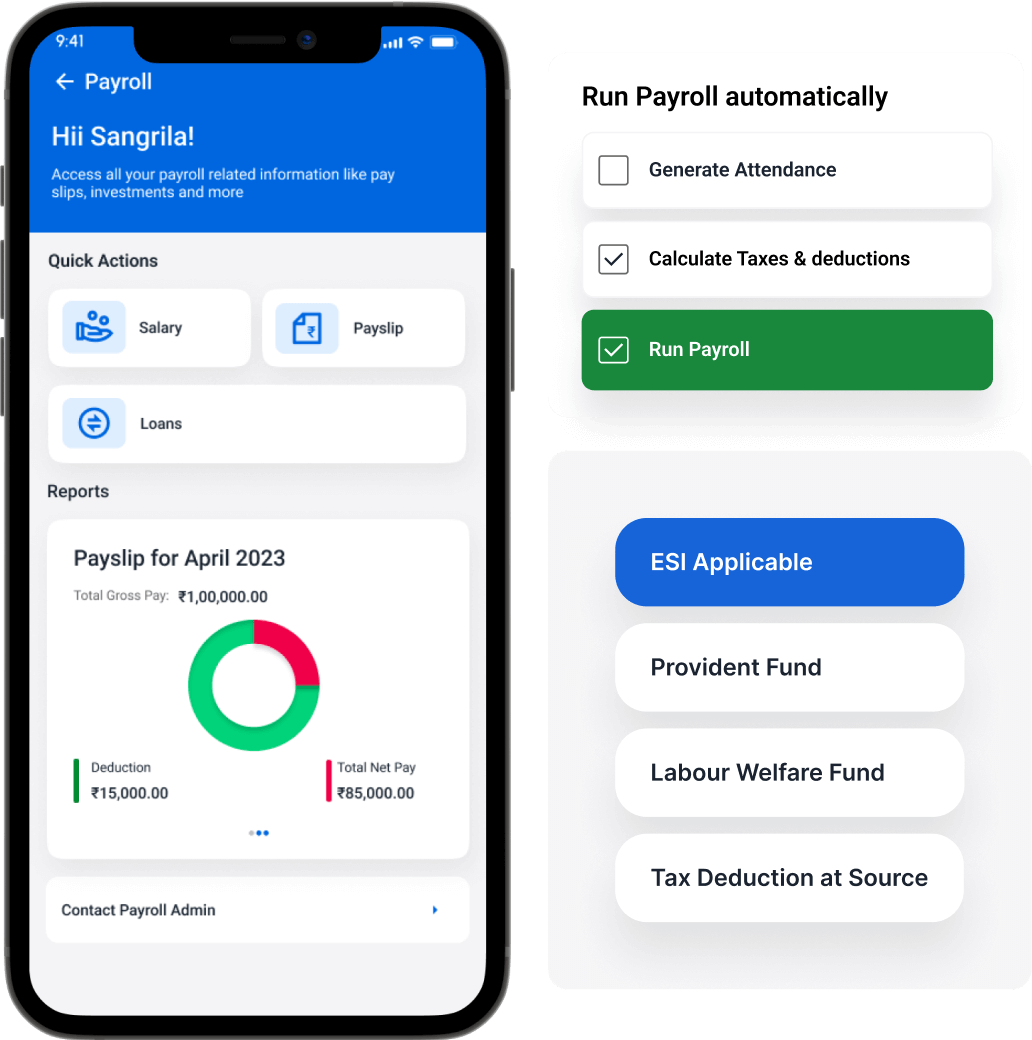

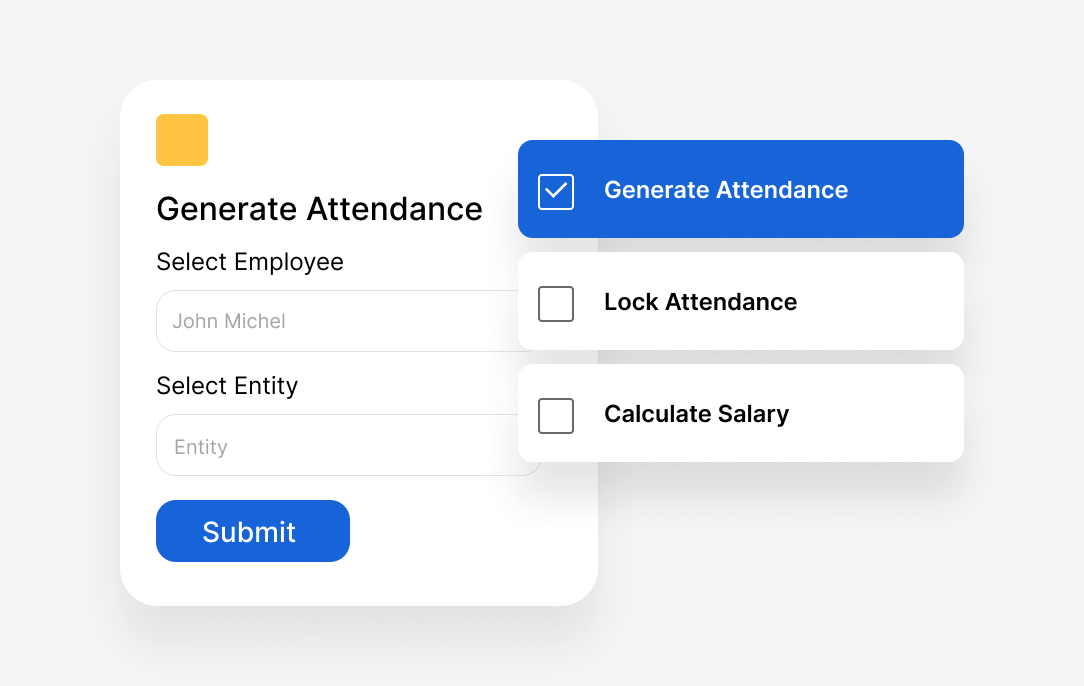

Automate the long complex process of calculating employee salaries, taxes, deductions, and benefits in just a few clicks.

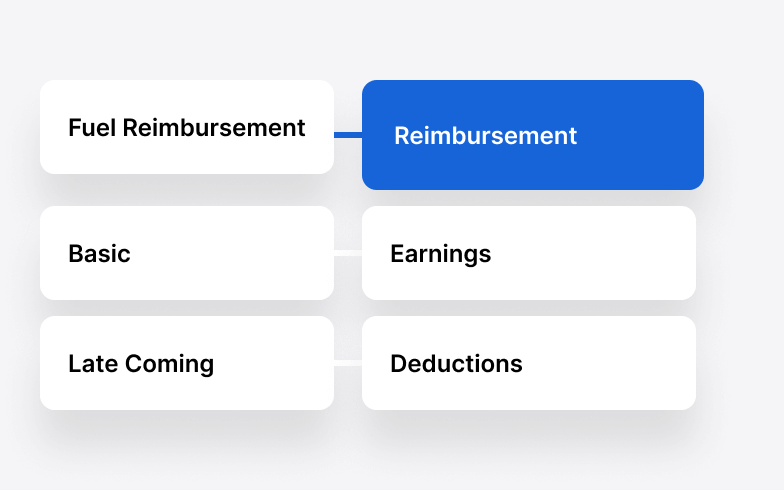

Accurately calculate and process employee salaries while accommodating various compensation structures and financial adjustments within the organization.

Streamline payroll processing by accurately computing various deductions based on applicable tax laws, government regulations, and employee-specific information.

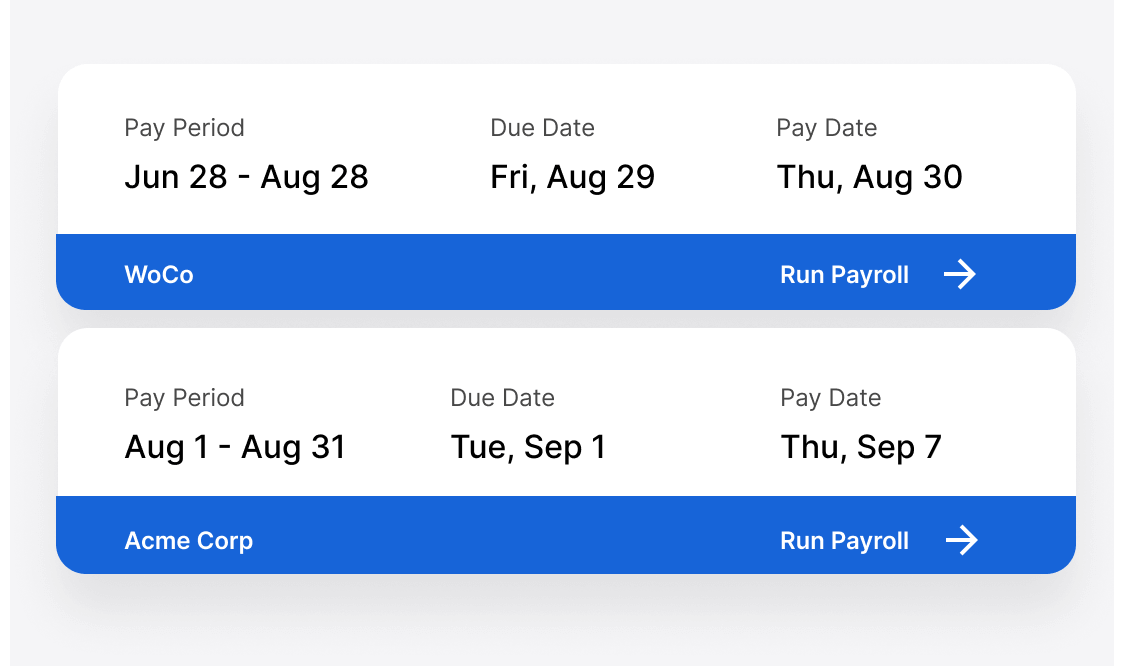

Organize employees into distinct pay groups based on employment type, department, or location and set up multiple pay frequencies to align with the company's payroll schedule and compliance needs

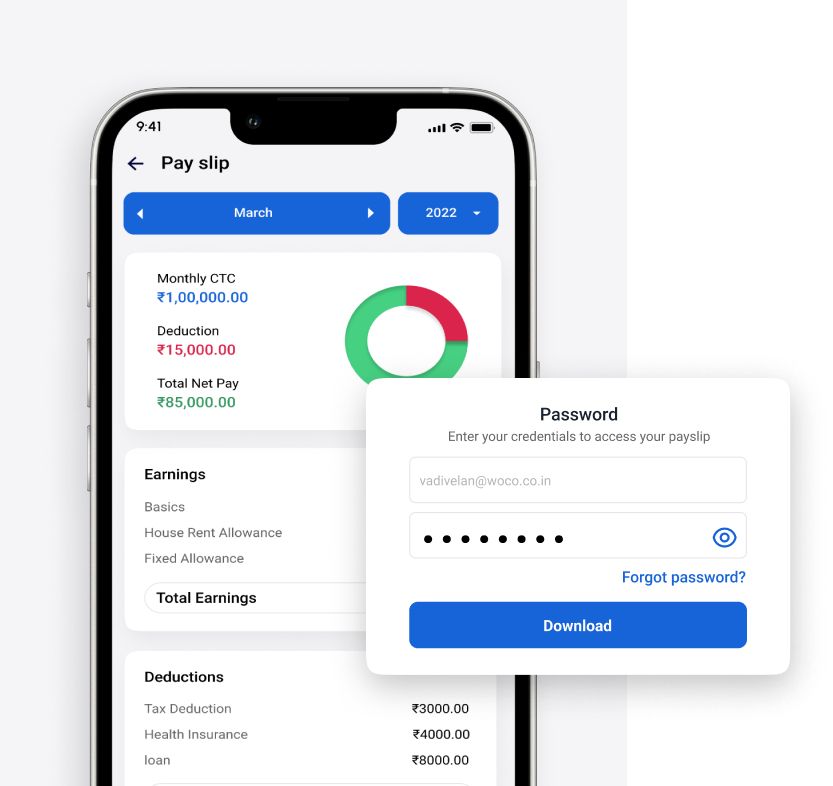

No longer spend hours to generate and send payslips manually. WoCo payroll auto generates & send employee pay slips within minutes

Empower employees with easy access to their salary information

Submit tax declarations and investment proofs

View and download payslips and Form 16

Submit and track expense claims and reimbursements

Stay up-to-date with labor laws and regulations

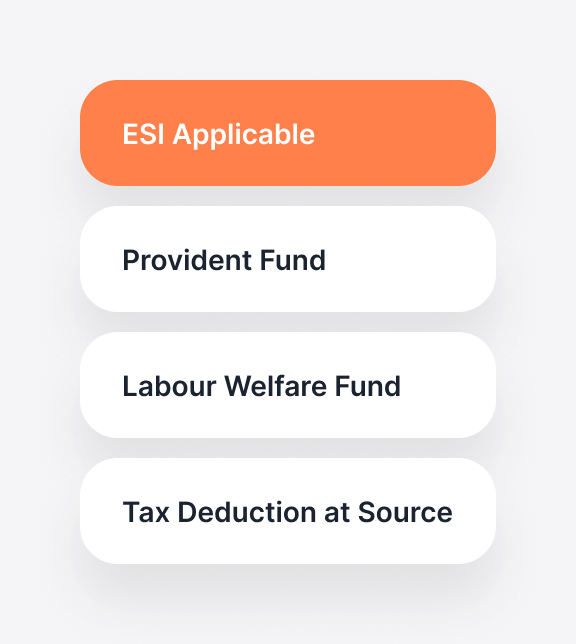

Automated PF, ESI, PT, TDS, and LWF calculations

Generate accurate and timely challans & returns

Access customizable compliance reports for audits

Words of love from our clients

Schedule a call today and get:

Insights on how you can streamline HR & Payroll

Valuable resources & best practices

Get HR related templates and checklists